Introduction

In today’s dynamic market, commercial real estate is a beacon of opportunity for savvy investors. With its unique advantages and potential for lucrative returns, it’s no wonder that more and more investors are turning to commercial properties to diversify their portfolios and secure their financial future. Let’s explore the compelling reasons why commercial real estate is a smart investment choice in today’s ever-changing landscape.

Why Invest in Commercial Real Estate?

In this section, we will delve into the reasons why investing in the commercial real estate sector can benefit you as an investor, provide several benefits, and enhance revenue generation:

1. Diversification of Investment Portfolio

Investing in commercial real estate is smart for those looking to diversify their investment portfolio. Unlike stocks and bonds, real estate moves differently in the market, providing a cushion when other investments might be underperforming. You’re more likely to achieve a balanced and resilient portfolio by spreading your investments across different asset classes. Diversification can be the key to maintaining steady growth, even in turbulent times.

2. Capital Appreciation

The possibility of capital appreciation is one of the strongest arguments for investing in commercial real estate. Commercial properties frequently see value increases over time due to advancements, modifications, and market shifts. It is a long-term investment with the potential to yield significant profits, making it a desirable choice for people who want to increase their wealth gradually.

| DID YOU KNOW? The Indian real estate sector reached USD 265.18 billion in 2023, with an anticipated surge to USD 828.75 billion by 2028. Commercial real estate offers higher returns than residential investments, driven by increased rental income and capital appreciation, albeit with higher risk but less management complexities due to fractional ownership platforms. |

3. Hedge Against Inflation

Real estate has historically been an effective hedge against inflation. As the cost of living increases, so too can the value and rental income from commercial properties. It is because, in an inflating economy, the demand for space drives up rents, increasing the property’s value. Investing in commercial real estate can provide investors with a measure of protection against the eroding effects of inflation on their purchasing power.

4. Steady Rental Income

Commercial real estate investments can benefit from steady rental income. Properties like office buildings, retail spaces, and industrial facilities can generate consistent cash flow through lease agreements with tenants. This rental income can be a reliable source of revenue, often higher than one might expect from other investment types. It’s not just about the money coming in but also about the predictability and stability that rental income provides investors.

5. Tax Benefits and Depreciation

The tax advantages of investing in commercial real estate can be significant. To lower their taxable income, owners can write off costs like mortgage interest, management fees, and upkeep of their real estate. Depreciation can also be used as a non-cash income deduction, which reduces taxable income even further. These advantages can increase overall profits through tax savings, making commercial real estate an even more alluring investment.

6. Wealth Building and Retirement Planning

Investing money into commercial real estate can be a great way to grow wealth and prepare for retirement. Over time, tax benefits, consistent rental income, and capital appreciation can help accumulate significant wealth and savings. Commercial real estate offers individuals seeking to safeguard their financial future a physical asset that provides security and stability.

- Analyzing the Current Trends in Commercial Properties

Commercial buildings utilise state-of-the-art technology to optimise operational efficiency and improve the remote work experience by integrating innovative office features. These properties have revolutionised their infrastructure by combining automation systems and Internet of Things (IoT) gadgets, which allow for intuitive control over various components of the work environment and seamless connectivity.

(Source)

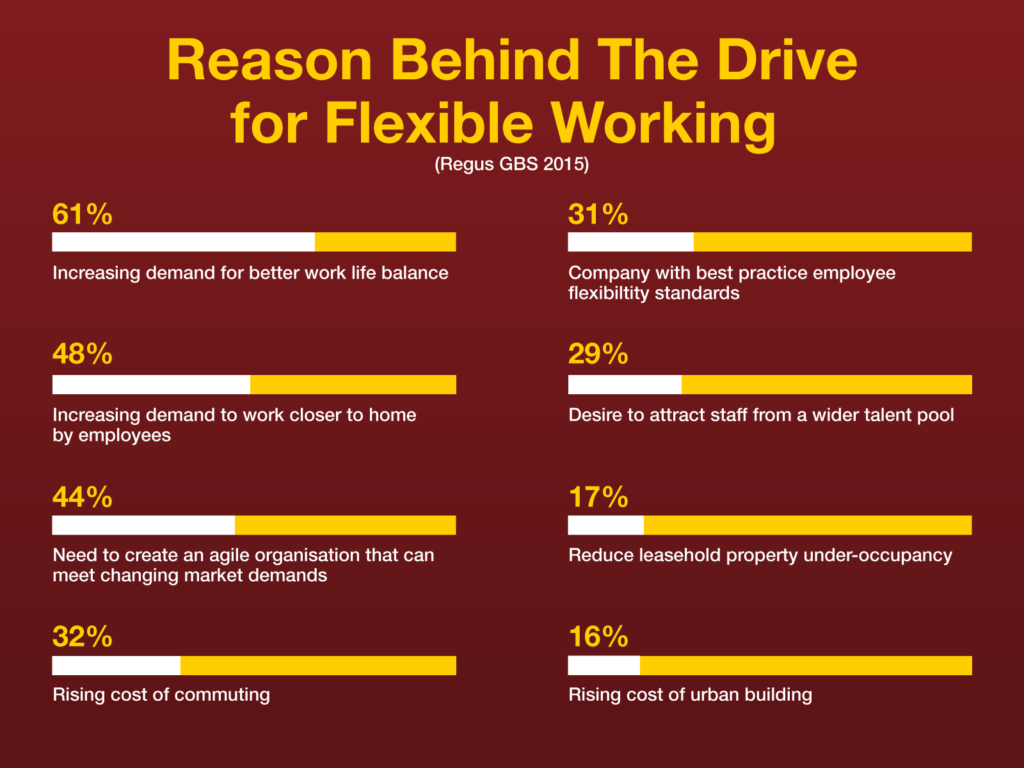

| DID YOU KNOW? According to Regus Research, 93% of employees prefer organisations offering remote working chances, and 61% of workers are willing to switch employment to acquire flexible working options. Slow Rebound in Office Space Demand Expected in 2024 – NAIOP: This forecast suggests cautious optimism for the office space market, projecting a net absorption of approximately 4.5 million square feet during the first three quarters of 2024. |

Impact of Technology and Remote Work on Commercial Real Estate

The impact of technology and remote work on commercial real estate is profound and multifaceted. Technology advancements have led to smarter, more efficient buildings, while the rise of remote work is reshaping demand for office spaces, favouring flexible and hybrid work environments.

This shift challenges traditional commercial real estate models, encouraging innovation in how spaces are designed, used, and valued. As a result, there’s a growing emphasis on adaptability, with commercial properties increasingly being repurposed to meet changing needs and preferences.

| DID YOU KNOW? Record Office Leasing in 2023: Chennai recorded the highest-ever office leasing in 2023, with 10.5 million square feet (MSF), setting a strong foundation for 2024. Expected Rise in Real Estate Prices: Real estate prices in Chennai are expected to rise by 5.5-6.5 per cent and by nearly 7.5 per cent across India, making it a suitable time for investment. Shift Towards Commercial Real Estate: A pivotal change in 2023 saw NRI investors redirecting their focus from residential to Grade A commercial real estate, with an expected Compound Annual Growth Rate (CAGR) of 9.2%. This trend will likely continue into 2024, indicating a strong interest in commercial investments. Anticipated Rise in NRI Real Estate Investments: According to reports, NRI real estate investments in India are expected to rise by 20–25% by 2024. This increase is a clear indicator of the growing interest and confidence of NRIs in the Indian commercial real estate sector. |

Risks and Challenges in Commercial Real Estate Investment

Understanding these risks is crucial for investors to make informed decisions and protect their investments. Here are some key risks and challenges:

1. Market Volatility and Economic Downturns

Investments in commercial real estate can be significantly impacted by market volatility and economic downturns. Property values can change during erratic times, which could impact prospective returns. To reduce these risks, investors should diversify their holdings, keep up with market developments, and be ready to modify their approaches.

2. Vacancy Rates and Tenant Turnover

For investors in commercial real estate, high vacancy rates and frequent tenant turnover can provide difficulties. Lost rental revenue and higher maintenance and marketing costs result from vacant properties. Investors should concentrate on tenant retention tactics, maintain their properties to draw and keep renters and be proactive in resolving tenant issues to reduce turnover and overcome these difficulties.

3. Financing Risks and Interest Rates

The profitability of investments in commercial real estate can be impacted by financing concerns and interest rates. Interest rate fluctuations can influence cash flow by changing the cost of borrowing and mortgage payments.

Risk Mitigation and Strategies for Success In Commercial Real Estate Investment

The following section will discuss effective risk mitigation strategies and critical factors for commercial real estate investment success.

1. Due Diligence in Property Selection

Don’t Rush! Conduct thorough due diligence before investing in a property. Research the market, analyze the property’s potential for appreciation, and review the property’s history and financials. A well-informed decision today can lead to profitable returns tomorrow.

2. Tenant Screening and Lease Management

Quality over quantity! Screen tenants rigorously to ensure they are reliable and have an excellent rental history. Establish clear lease agreements to protect both parties’ interests and manage leases efficiently to avoid conflicts and ensure timely payments.

3. Property Maintenance and Upkeep

Regular maintenance and upkeep are crucial to preserving the value of your property. Schedule routine inspections, address maintenance issues promptly, and invest in preventive maintenance to avoid costly repairs.

4. Professional Advisors and Real Estate Experts

Seek advice from professionals and experts in the real estate industry. Real estate agents, property managers, and financial advisors can provide valuable insights and guidance to help you make informed decisions and navigate the complexities of the real estate market.

Unlock your Investment Potential in the Market of India

Step into the realm of opportunity at Market of India, where we’re not just offering spaces but gateways to success. With shops available at an attractive starting price of just ₹45 lakhs, we’re making it easier for you to invest in a future filled with potential. Imagine securing a spot in Chennai’s most anticipated wholesale and retail hub, promising an impressive 15.5% return on your investment. For those looking to elevate their investment portfolio, we present an unparalleled opportunity with risk-free investments starting from ₹2 crores onwards.

Conclusion

In wrapping up our exploration, we’ve delved into the multifaceted advantages of commercial real estate investment in today’s market. From the promise of robust returns to the allure of portfolio diversification and the stability it brings amidst economic fluctuations, we’ve uncovered the strategic significance of this investment path. As we navigate the complexities of the market, the insights shared here illuminate the path to surviving and thriving through smart property investments. Together, we’re paving the way for a prosperous financial future.

FAQs

1. What do Chennai’s rising real estate values indicate for investors?

The anticipated 5.5-6.5% rise in real estate prices in Chennai and nearly 7.5% across India signals a robust market with strong potential for capital appreciation, making it an excellent opportunity for a real estate investment.

2. How does the record office leasing in Chennai in 2023-24 affect commercial real estate investment?

Chennai’s record office leasing in 2023, with 10.5 million square feet leased, underscores a vibrant demand for commercial spaces, indicating a solid foundation for investments in the coming year.

3. How does technology impact commercial real estate investments?

Advancements in technology enhance the operational efficiency and adaptability of commercial spaces, making them more attractive to tenants seeking modern, flexible work environments.

4. What are the prices of shops and the expected ROI in the Market of India?

Commercial shops at the Market of India start at ₹45 lakhs. Book now and get an assured rental of ₹100 per sq. ft.

0 Comments