Introduction

In this blog, we will delve into the exciting opportunities that 2024 holds for investors in commercial real estate, with a particular focus on commercial shops and office spaces.

As the market landscape evolves, these investment avenues are emerging as promising bets for those looking to diversify their portfolios and tap into the potential of the burgeoning real estate sector.

Join us as we explore why commercial shops and office spaces are poised to be your best bet in the upcoming year.

Office Space Demand to Propel the Market in India

- Office Spaces: The national office vacancy rate reached 19.2% in Q3 2023, with some older Class B and C offices facing obsolescence. There is potential for opportunities to convert central business districts’ office space into apartments or data centres.

According to a recent study by real estate consultant Colliers India, the office space supply in six significant cities has significantly increased. From January to September last year, the supply surged by 49%, reaching 32.8 million square feet.

This surge can be attributed to the completion of various commercial developments to meet the growing demand for office spaces. In the same period last year, the supply stood at 22 million square feet across the cities of Bengaluru, Chennai, Delhi-NCR, Hyderabad, Pune, and Mumbai, as reported by Colliers India.

On the other hand, Chennai recorded the most significant surge in new office spaces, with the supply skyrocketing from 0.9 million square feet to 4.2 million square feet.

- Industrial sector: Industrial developers completed a record 607 million square feet of new supply in 2023 in response to the high demand in 2021 and 2022.

Net absorption indicates that, in the meantime, demand reached around 231 million square feet, up from the pre-pandemic total of 219 million square feet in 2019 but down 54% from 2022. There is a strong demand for industrial and commercial space, as evidenced by the predicted continued increase in net absorption. This indicates robust growth in the industrial market.

| India’s Commercial Real Estate to Soar: Knight Frank Predicts 7-8% Growth in 2024 According to Gulam Zia, Senior Executive Director at Knight Frank India, the commercial real estate sector in India is anticipated to experience a remarkable growth of 7-8% in 2024. This positive forecast of the Economic Times is attributed to the expansion of global capability centers and the favorable position of the Indian economy. Despite the challenges encountered in 2023, the commercial real estate industry witnessed a significant recovery, with absorption levels almost reaching pre-Covid figures. Additionally, the increasing number of ultra-high net worth individuals (UHNIs) in India, projected to rise by 50% annually, is expected to further bolster this optimistic projection. |

As we approach 2024, the commercial real estate industry, specifically commercial shops, displays encouraging indications of expansion. JPMorgan Chase reports that the prospects for commercial real estate in the upcoming year are being reassessed across all sectors, with multifamily and neighbourhood retail anticipated to maintain their strength.

The performance of various asset classes will differ, with neighbourhood retail emerging as a steadfast force in 2024. It is projected to exhibit consistent performance, with stable vacancy rates and rent growth showing moderate positivity.

- Exploring India’s Commercial Real Estate and Retail Market: Growth Trends and Projections

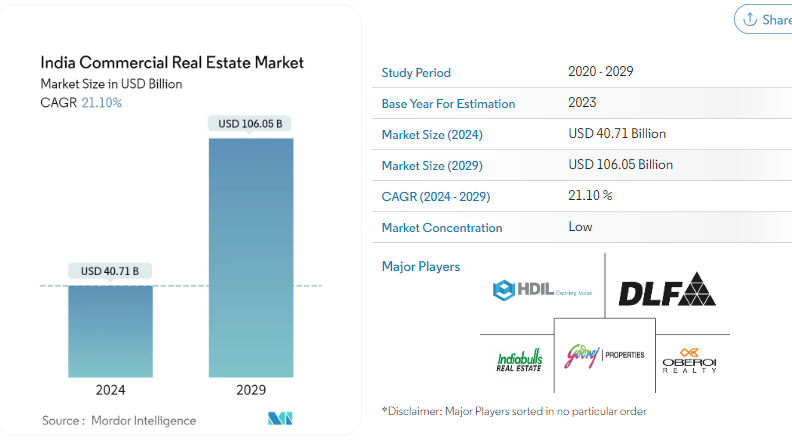

The Indian commercial real estate sector is set to experience significant growth in the upcoming years. It is projected that the market will reach a size of USD 40.71 billion in 2024 and is expected to further expand to USD 106.05 billion by 2029, with a compound annual growth rate (CAGR) of 21.10% during the forecast period (2024-2029).

In terms of retail, the Indian market is anticipated to reach $1.1 trillion by 2027 and $2 trillion by 2032, exhibiting a CAGR of 25%. India holds the 4th largest retail market globally, with the sector contributing over 10% to the country’s GDP and employing approximately 8% of the workforce.

Asia-Pacific Leads in Commercial Real Estate Growth with 5.3% CAGR (2020-2027)

The Asia-Pacific region is poised to lead the way in commercial real estate market growth from 2020 to 2027, boasting a remarkable Compound Annual Growth Rate (CAGR) of 5.3%. This statistic paints a vivid picture of the region’s upward trajectory, highlighting promising opportunities for investors, developers, and stakeholders looking to capitalize on this burgeoning market.

Unlock Lucrative Investment Opportunities in Market of India

Invest at ‘Market of India‘ for an unparalleled investment opportunity. With a diverse range of shops and office spaces, this innovative marketplace offers opportunities for entrepreneurs and businesses.

The Assured Rentals of Rs. 100 per sqft make it a commercial hub and a lucrative investment destination. With over 50+ trades, 1,00,000+ commodities, and nine distinct marketplaces, Market of India provides unrivaled options.

Explore Market of India for shops starting at Rs. 45 lakhs, Book your shop today and Assured Rentals of Rs. 100 per sq. ft. at Chennai’s largest upcoming marketplace!

Wrapping Up

In conclusion, the increase in vacancy rates is changing the commercial real estate market, especially in the office sector. For developers and investors, this offers both possibilities and challenges.

It will be crucial to monitor these trends and investigate creative approaches as 2024 approaches to navigate the changing commercial real estate market successfully.

0 Comments